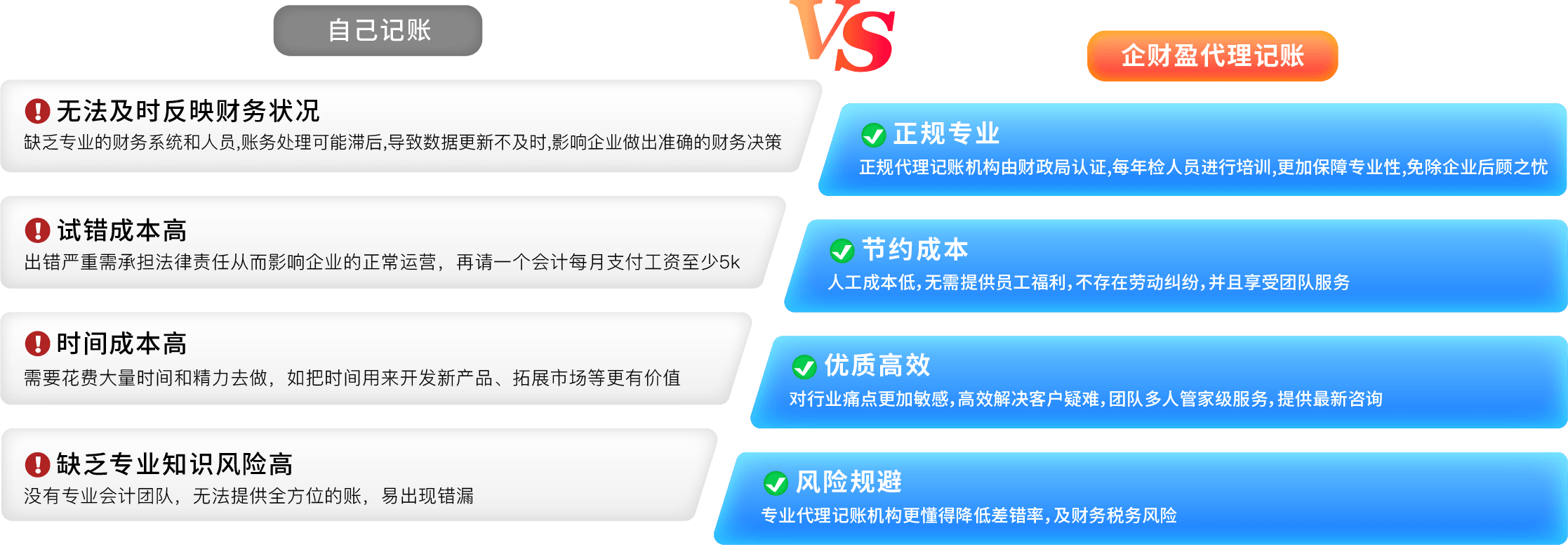

Self-accounting VS Agency Accounting

01 -

Domestic small-scale agency bookkeeping

Organize bookkeeping notes / Prepare bookkeeping vouchers / Monthly tax returns

Issuance of financial statements / binding of bookkeeping vouchers / annual income tax settlement

02 -

Domestic general agent bookkeeping

Organize bookkeeping notes / Prepare bookkeeping vouchers / Monthly tax returns

Issuance of financial statements / binding of bookkeeping vouchers / annual income tax settlement

03 -

Foreign small-scale agency bookkeeping

Organize bookkeeping notes / Prepare bookkeeping vouchers / Monthly tax returns

Issuance of financial statements / binding of bookkeeping vouchers / annual income tax settlement

04 -

Foreign general agent bookkeeping

Organize bookkeeping notes / Prepare bookkeeping vouchers / Monthly tax returns

Issuance of financial statements / binding of bookkeeping vouchers / annual income tax settlement

05 -

High-tech small-scale agency bookkeeping

Organize bookkeeping notes / Prepare bookkeeping vouchers / Monthly tax returns

Issuance of financial statements / binding of bookkeeping vouchers / annual income tax settlement

06 -

Hi-Tech General Agent Bookkeeping

Organize bookkeeping notes / Prepare bookkeeping vouchers / Monthly tax returns

Issuance of financial statements / binding of bookkeeping vouchers / annual income tax settlement

Dedicated Financial Advisor & Professional Team Support

Choose us to enjoy one-stop services from an exclusive financial advisor and an efficient team of professionals.

Helping you with all your belongings.

High efficiency and low cost

Intelligent automated batch operation, one-click management, centralized CA system, no manual labor required

Intervention with a hundredfold increase in efficiency.

Quality service experience

24-hour online service, real-time updates on service progress, personalized advice and recommendations.

Automatic risk warning

Standardized bookkeeping, automatic batch checking and early warning to reduce tax risks and ensure worry-free compliance.

Easy Management

Refined customer management, data visualization, service flow, standardization, so you can easily control.

Q&A Frequently Asked Questions

Zero declaration means that no taxable income occurs in the period to which the enterprise tax declaration belongs, and all the real declaration data of value-added tax (VAT) and enterprise income tax (EIT) for the current period are zero, which can be declared as zero.

(1) VAT small-scale taxpayers: zero declaration if current income is zero

(2) A general VAT payer can only file a zero return if there is no output tax and no input tax for the current period.

(3) An enterprise income taxpayer does not operate in the current period and can only file a zero return if its income and costs are zero.

No, industry and commerce, tax has been on June 1, 2015 with the People's Bank of China personal silver credit system networking, the company has not been canceled, you must do the accounts and tax returns, otherwise the legal person and shareholders will have a credit stain.

No. The Accounting Law of the People's Republic of China stipulates that all persons engaged in accounting must obtain an accounting license, and must be an accountant in order to do accounts.

Thank you for your submission, one of our consultants will be in touch with you shortly!