What is an ODI offshore investment filing?

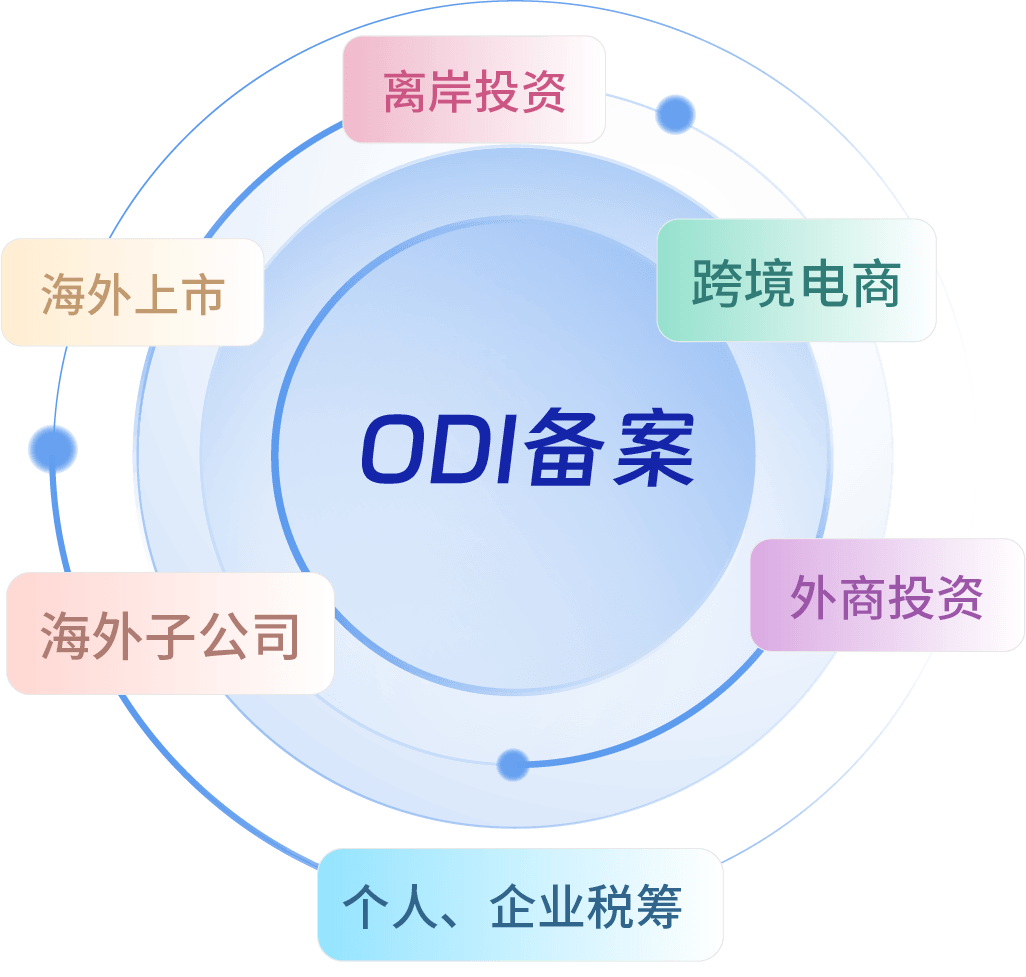

Overseas Direct Investment (Overseas Direct Investment) refers to the behavior of domestic enterprises and groups to acquire overseas ownership, control, management and other related interests through establishment, merger and acquisition, and participation in shares, etc., after approval by relevant departments. Commonly applicable situations include:

1. Offshore newly established company: refers to the enterprise to establish a new company outside the country, and the mainland companies as shareholders, shareholding ratio has no specific requirements.

2. Offshore merger and acquisition of companies: This refers to the acquisition by an enterprise of control or management of an already existing company by means of the purchase of equity or assets abroad.